Steady Growth with High-Return Options

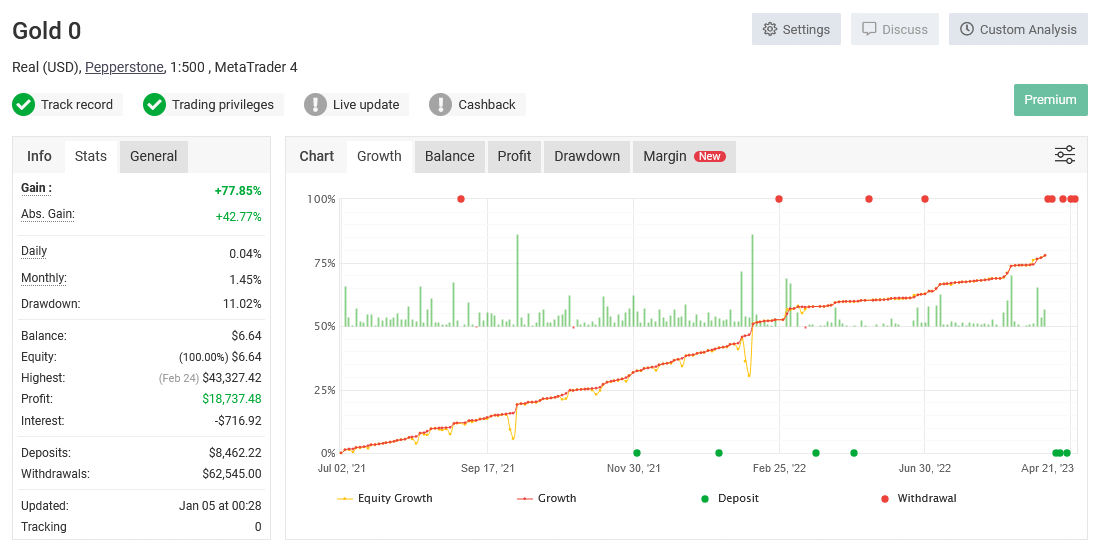

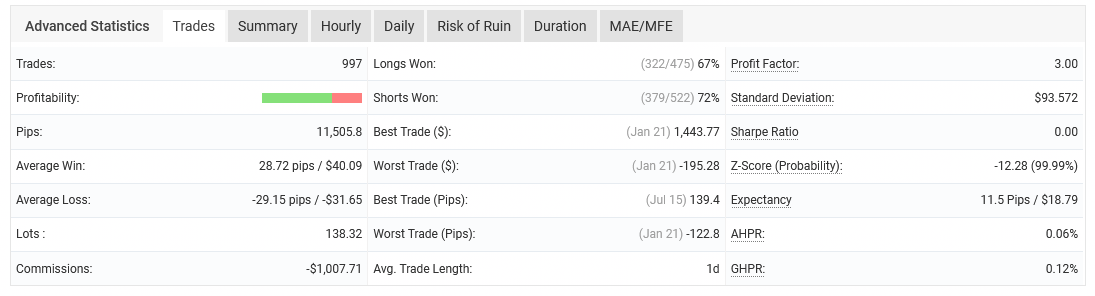

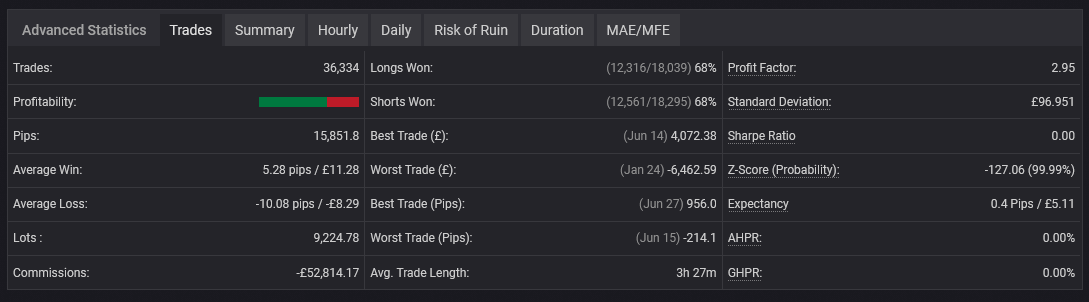

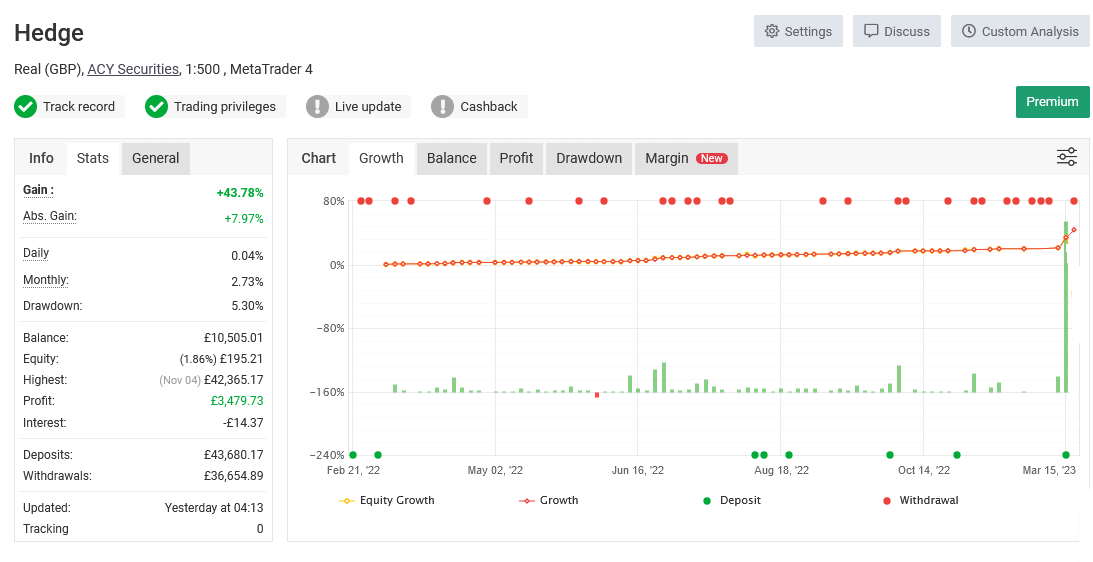

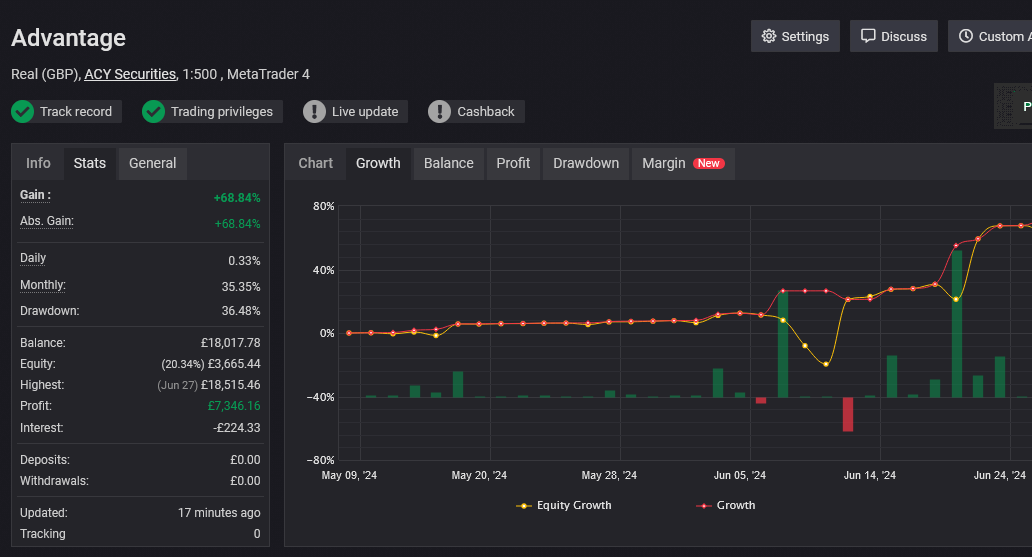

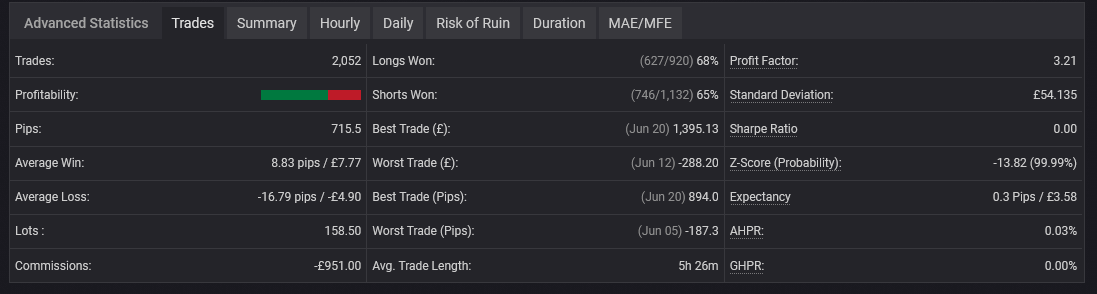

At White Associates, we prioritize steady, consistent growth in our trading strategies. Our primary account is designed with a conservative approach, minimizing risk per trade while achieving long-term growth. This slow-and-steady strategy is ideal for clients looking to build wealth over time without excessive volatility.

However, we understand that every client has different goals and risk tolerances and that majority would prefer bigger income. For those who prefer a higher return potential, we apply multipliers to your performance. This can increase annual returns to 20-40%, with maximum drawdowns around 20%, depending on your individual risk preferences and the tier you choose.

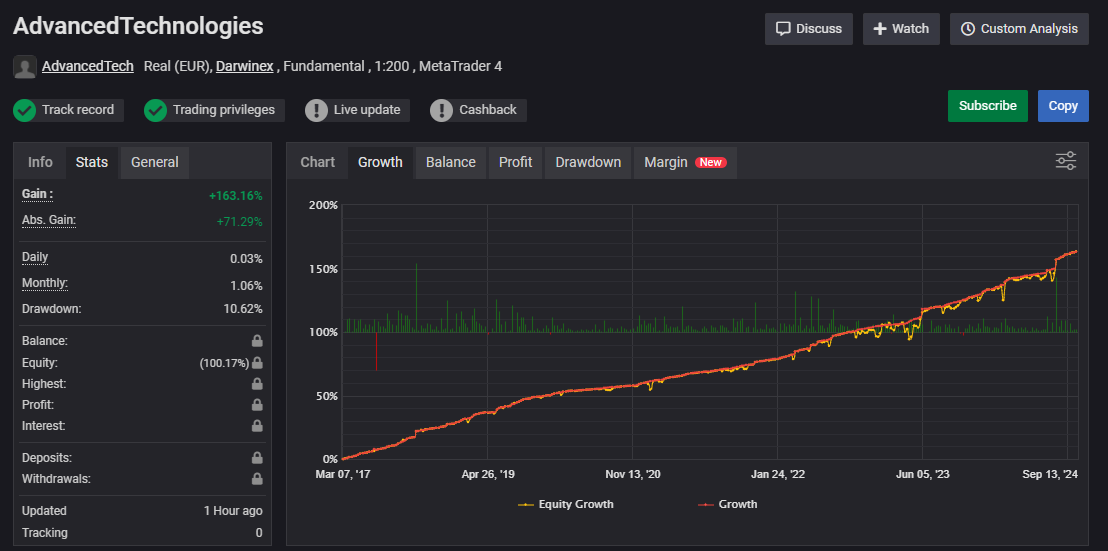

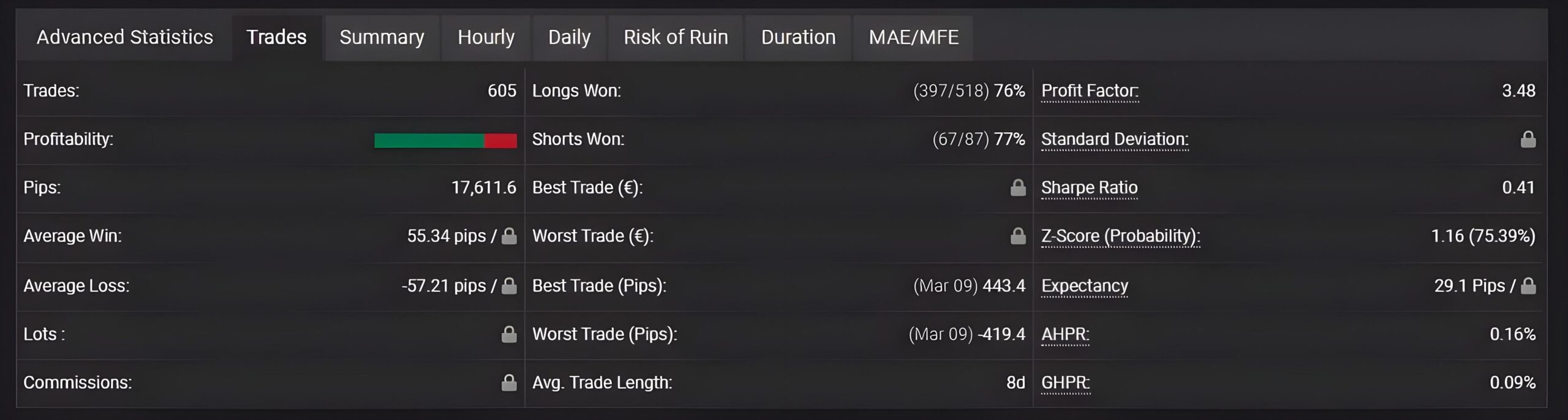

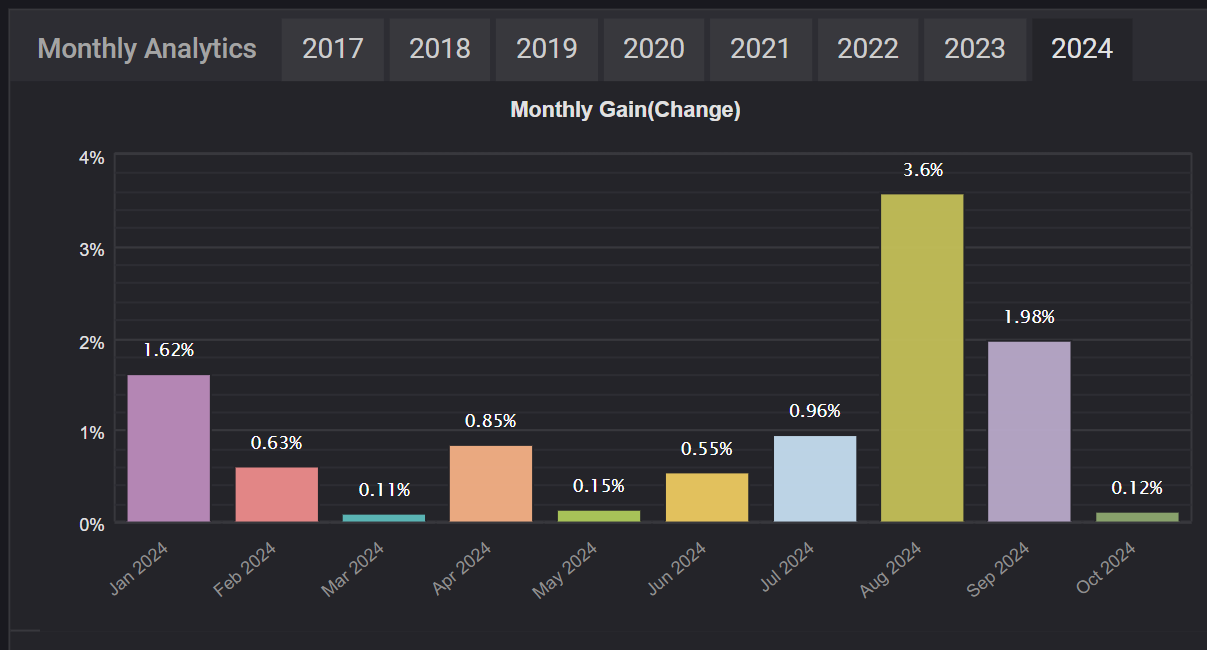

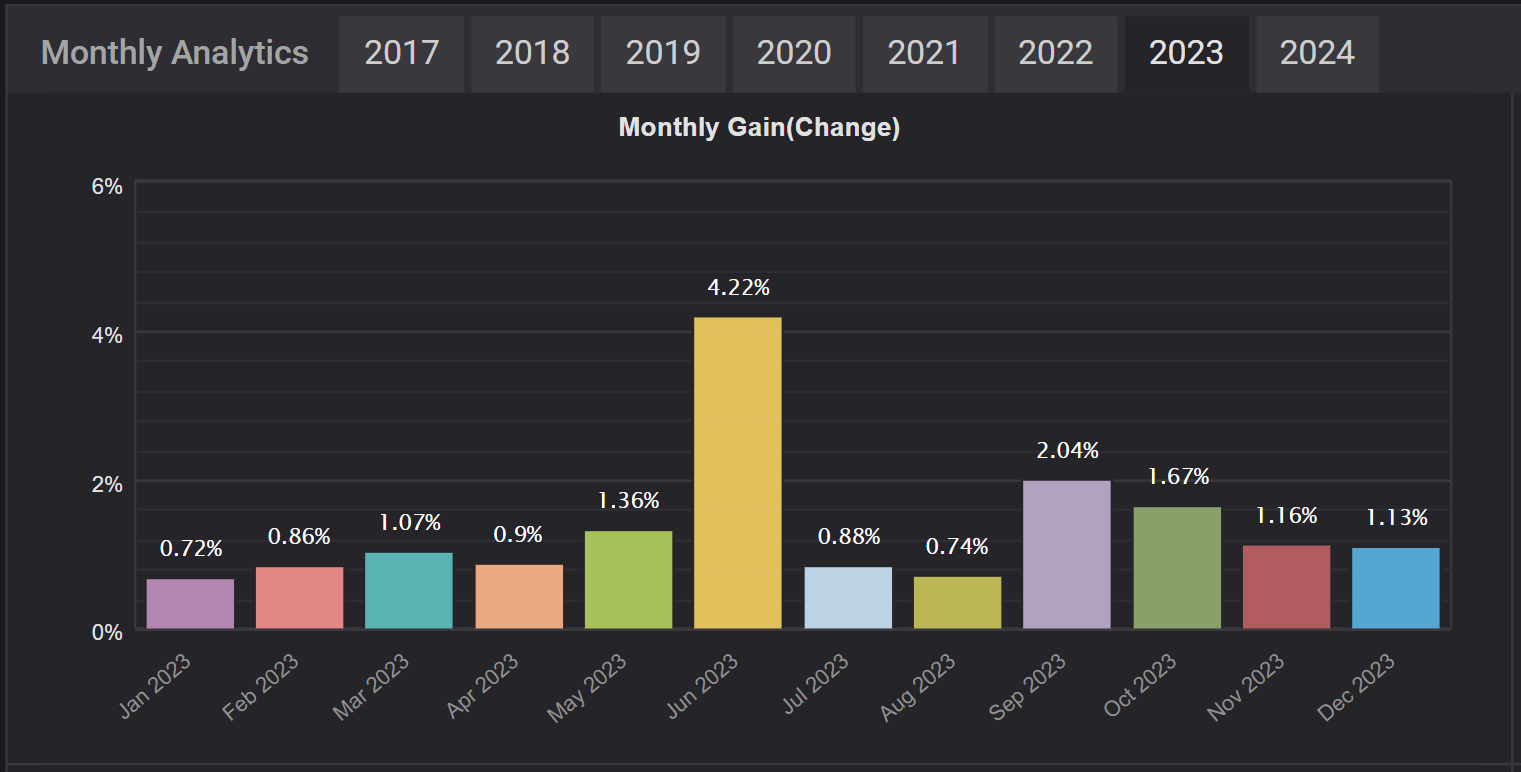

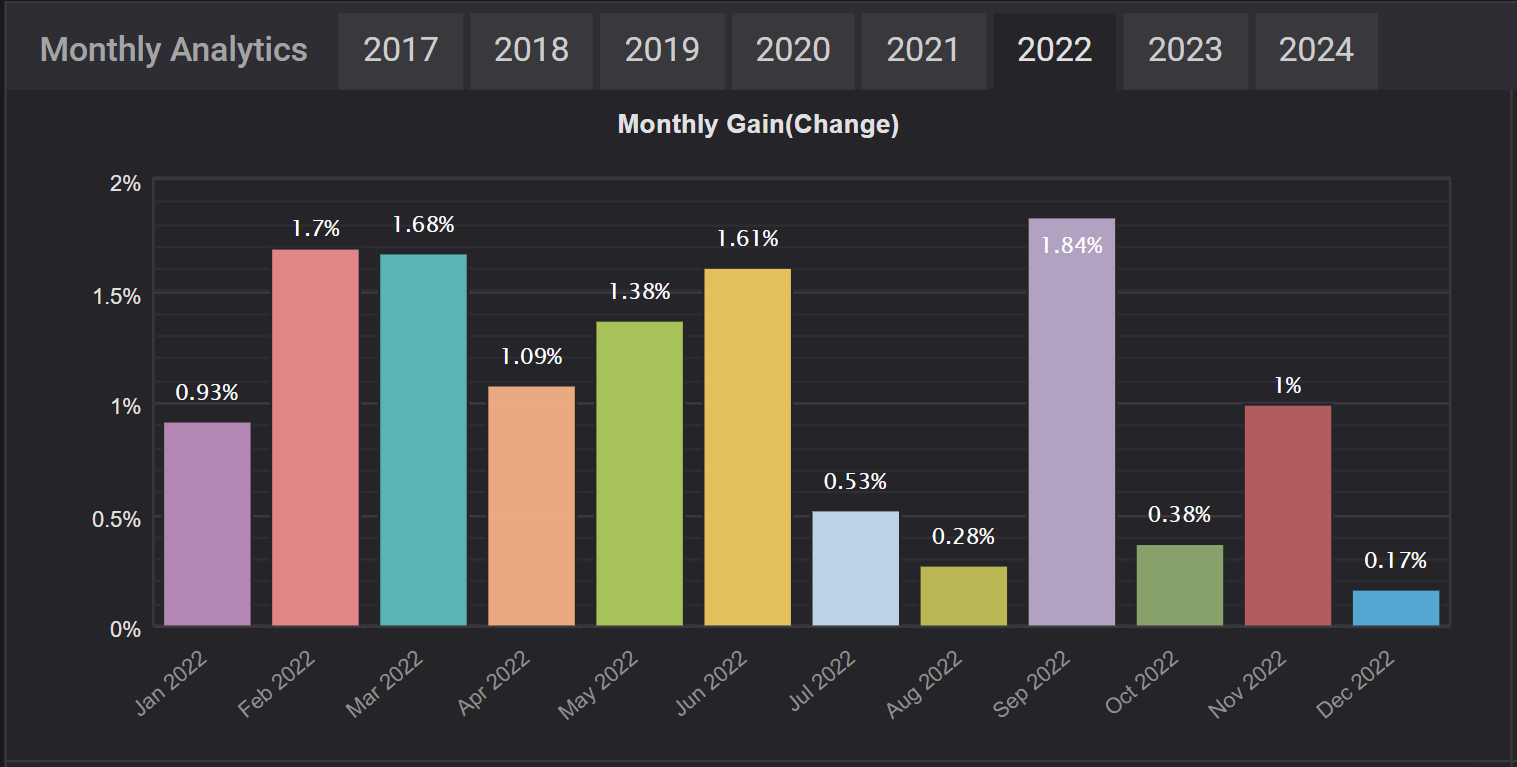

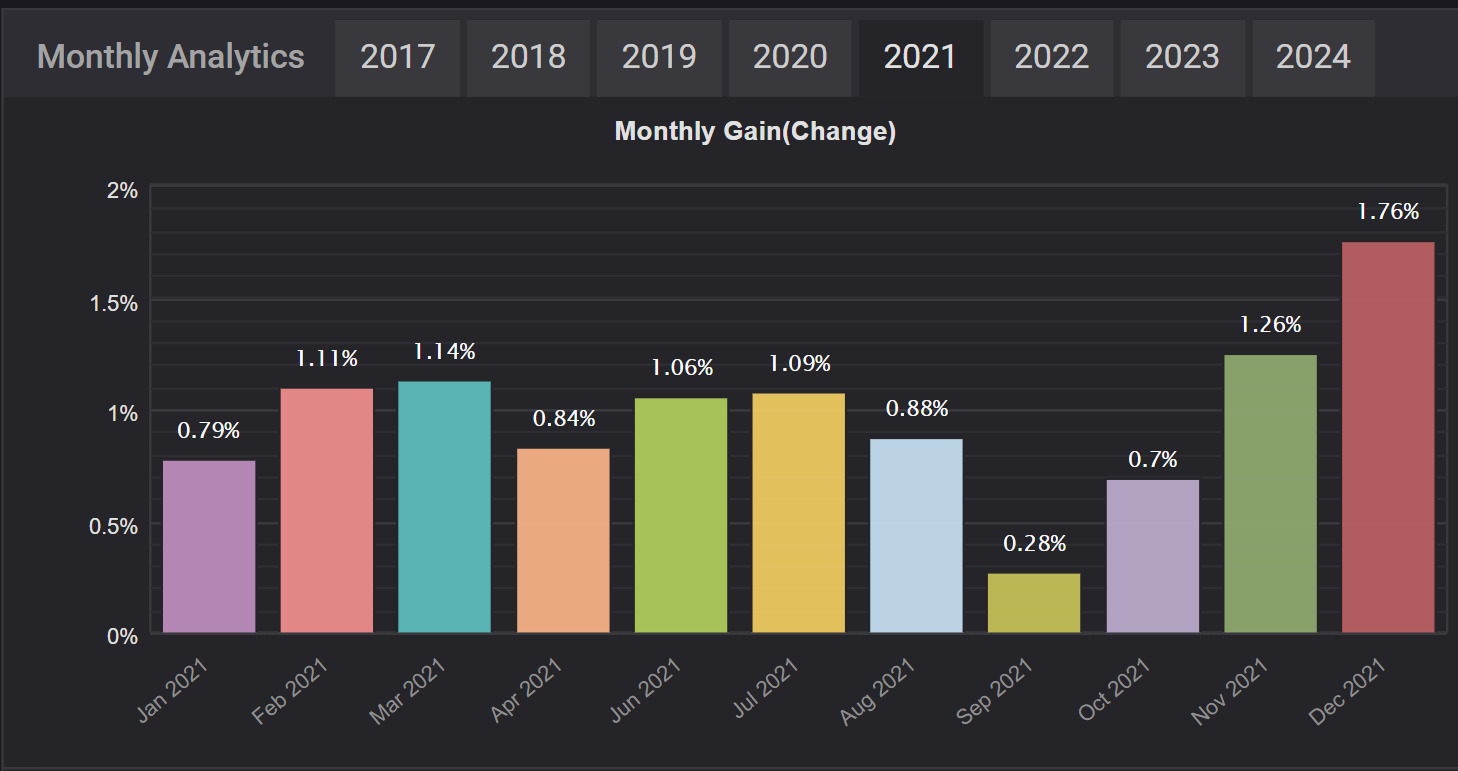

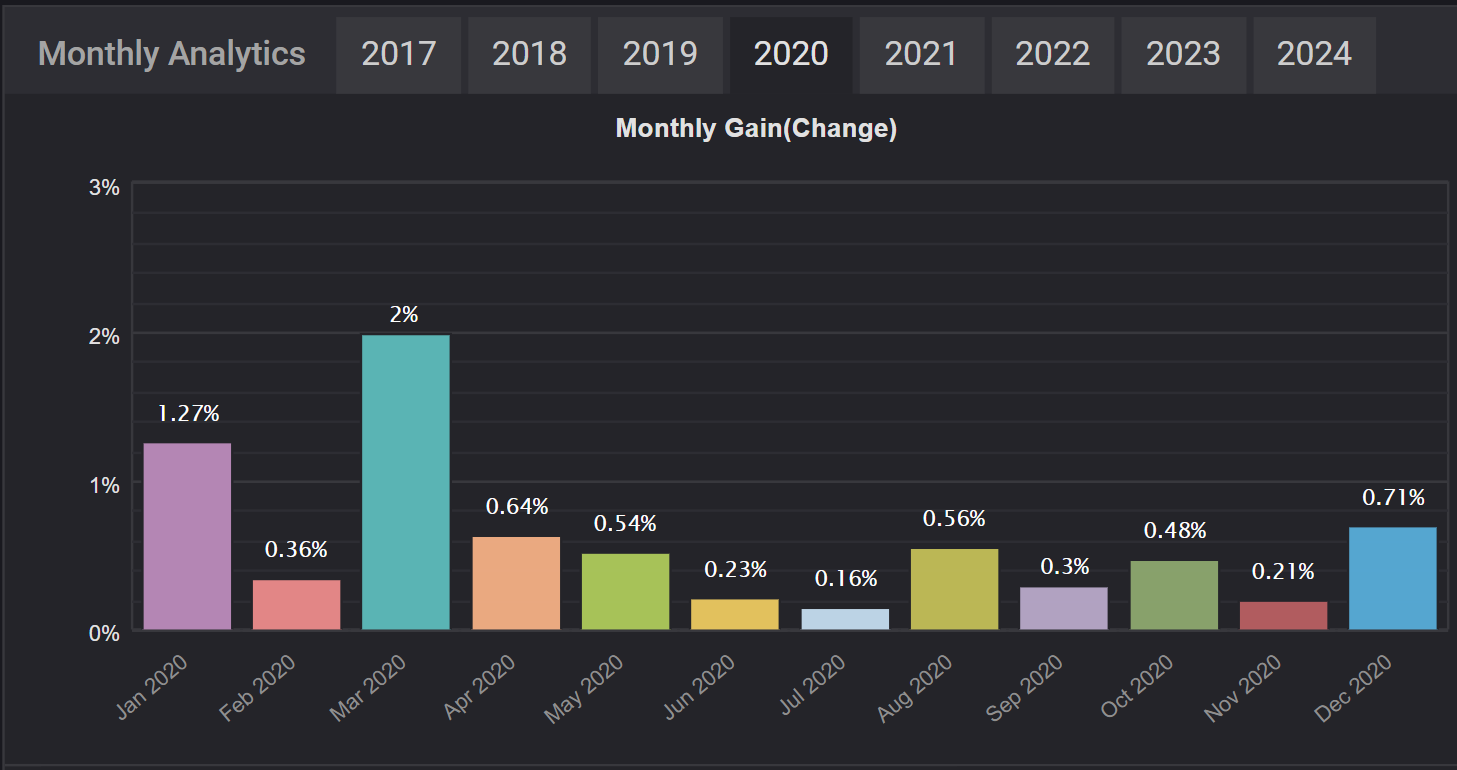

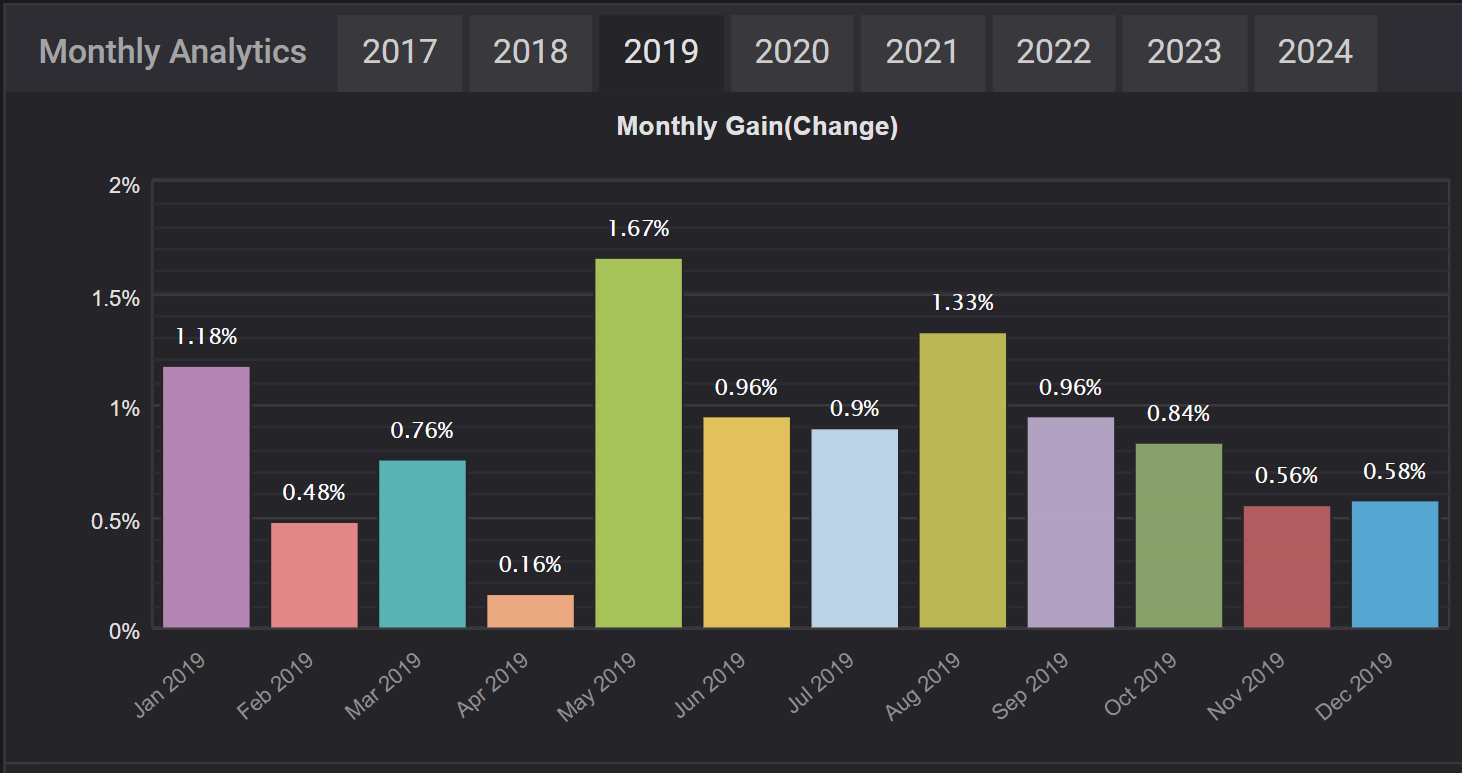

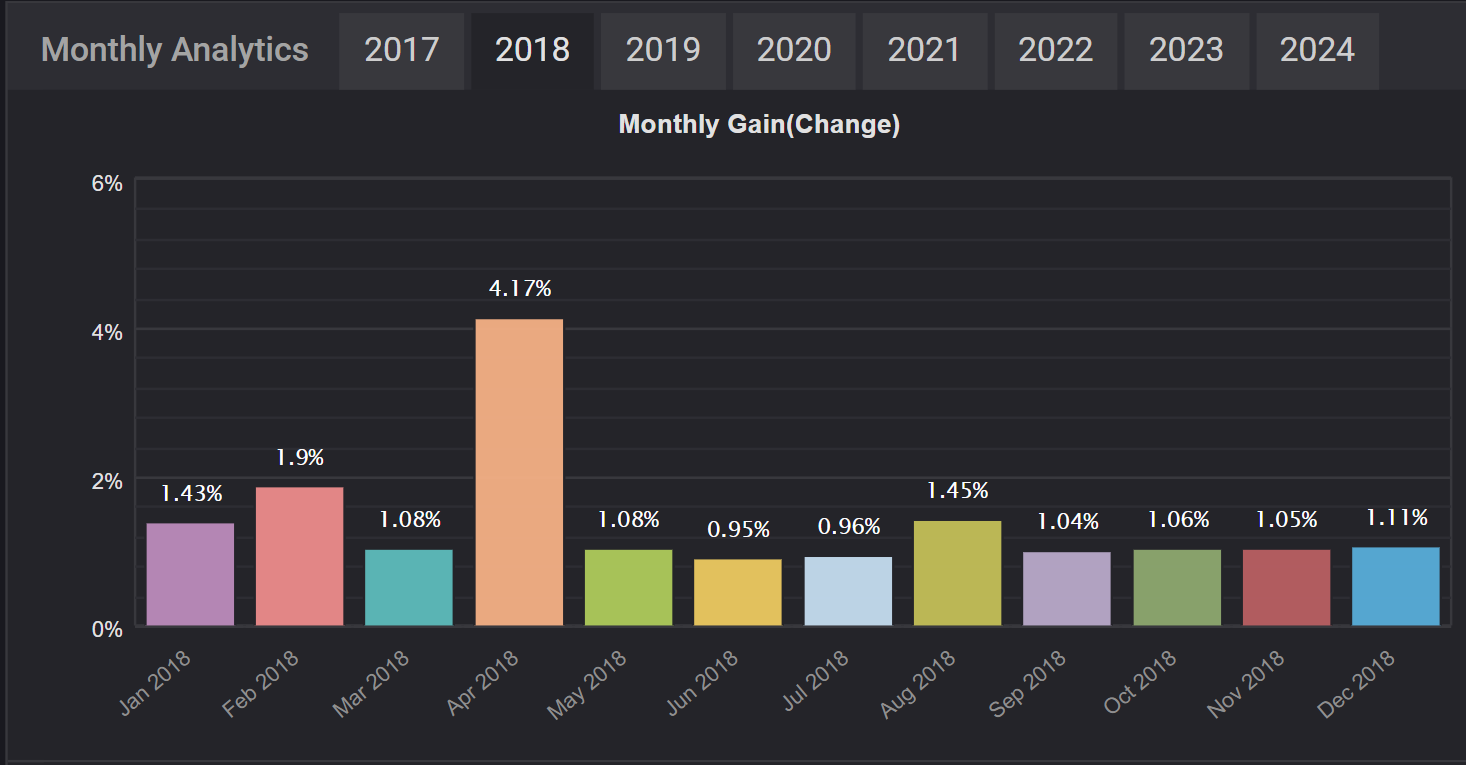

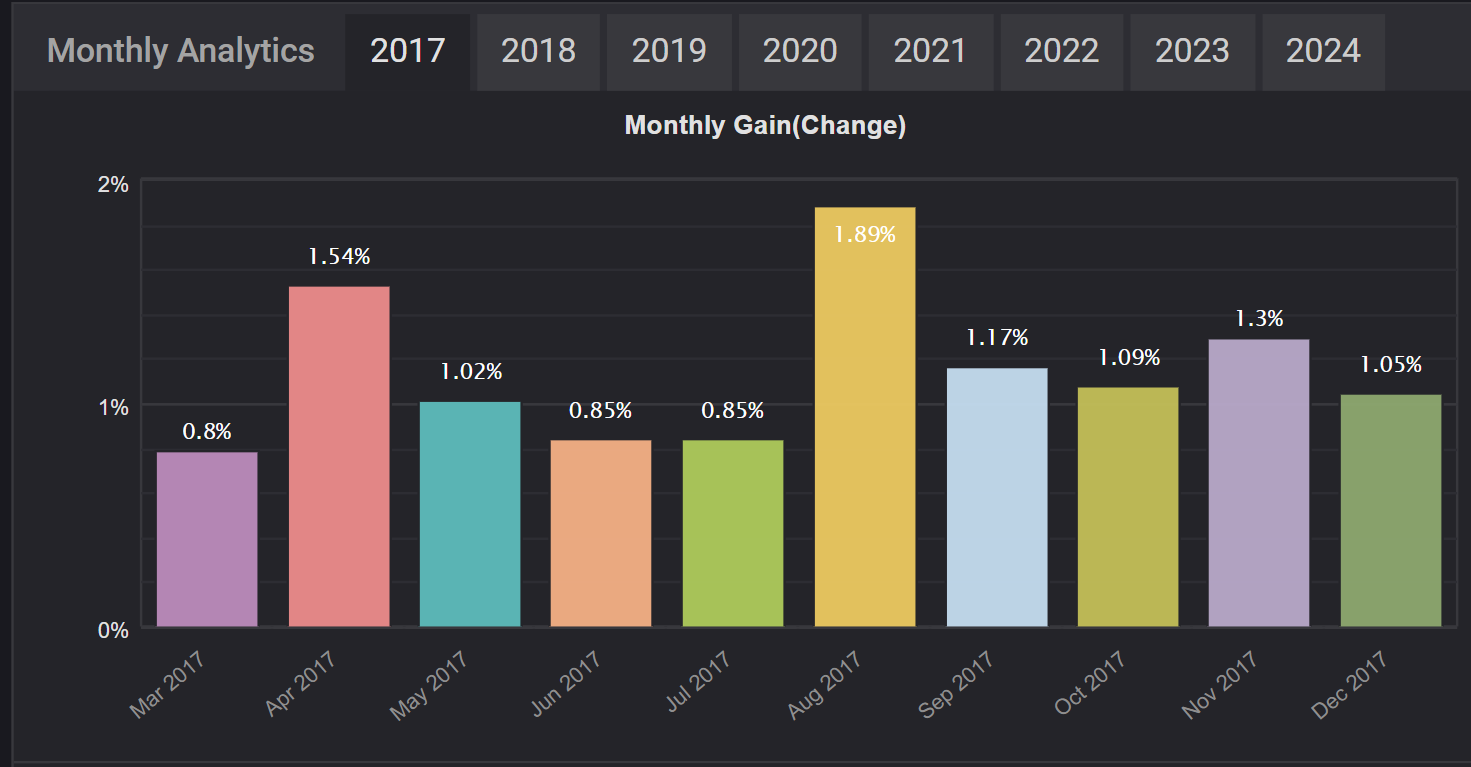

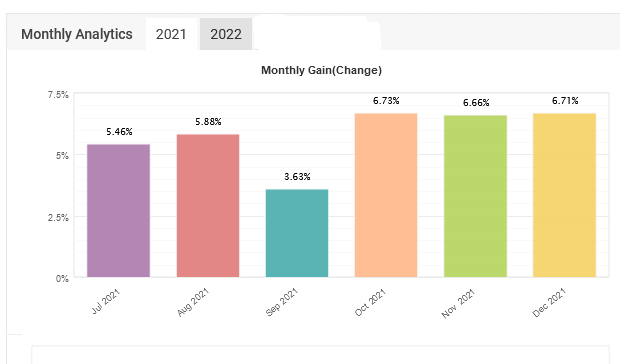

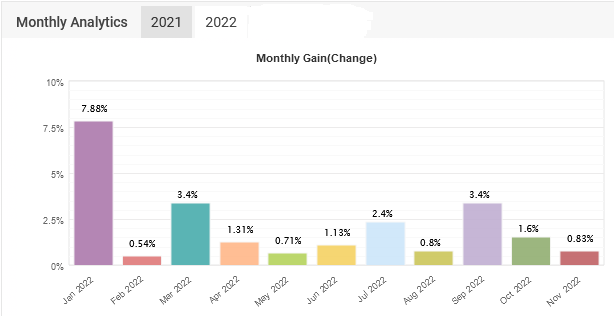

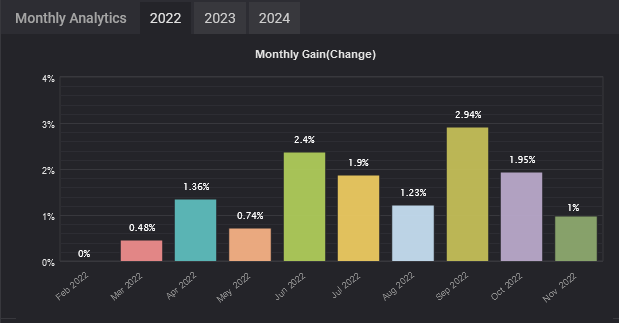

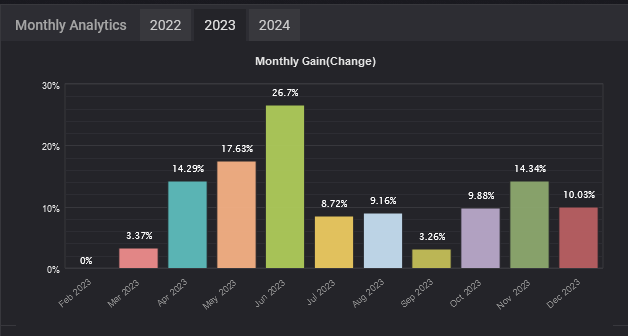

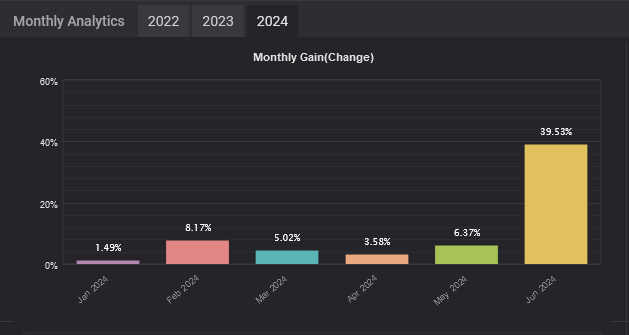

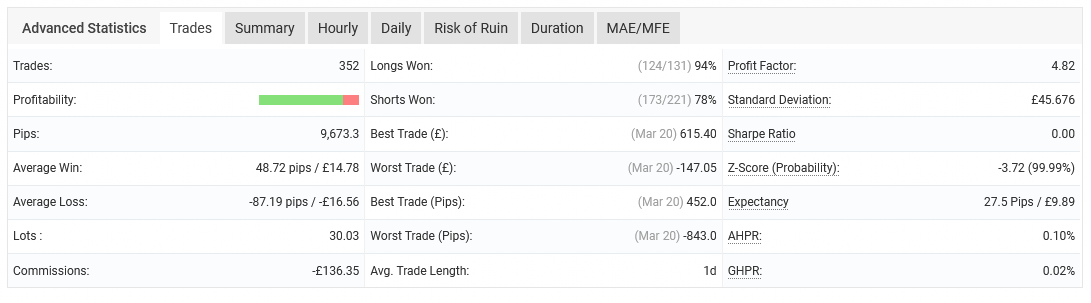

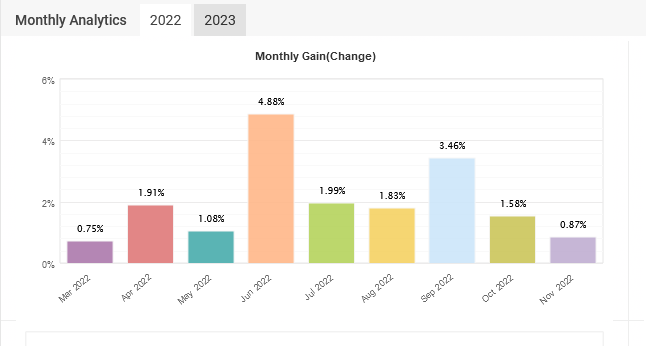

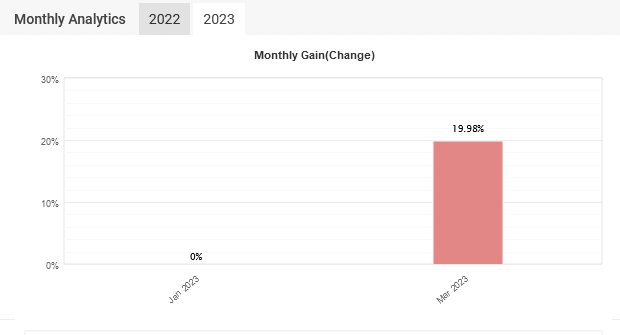

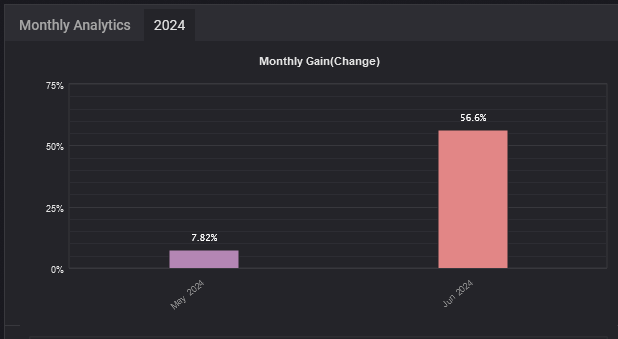

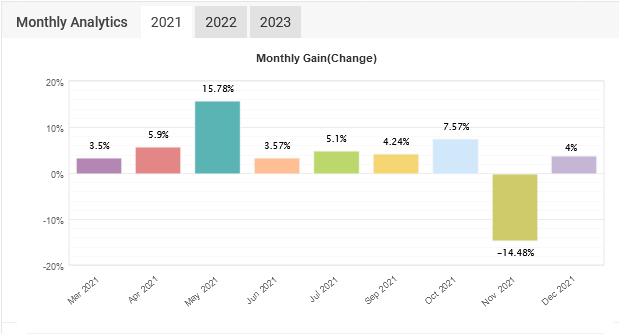

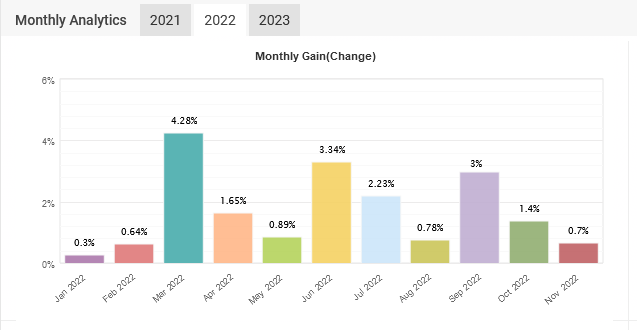

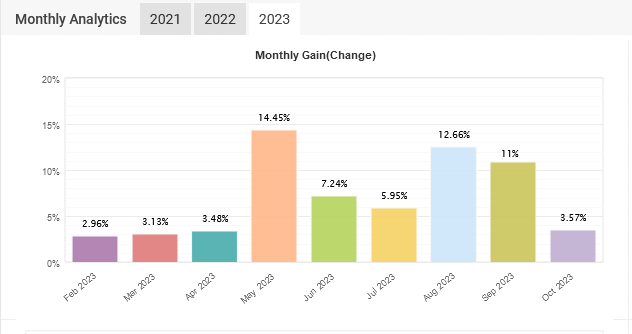

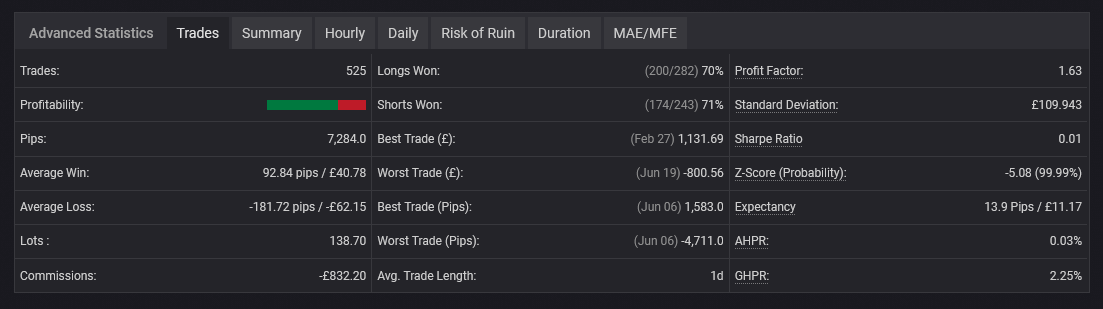

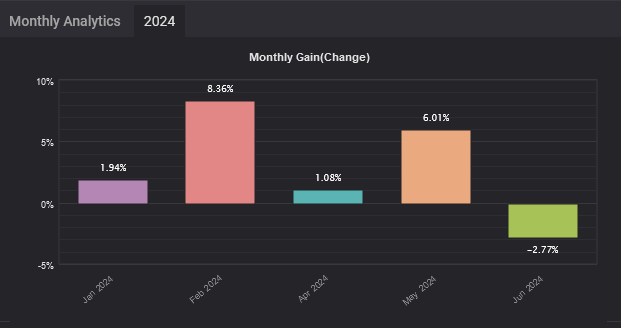

Our performance is fully transparent, and we provide detailed trading records for all to review. You can explore our past results, see how we’ve performed in different market conditions, and get a clear understanding of what you can expect based on the risk level you’re comfortable with.

Take a look below at our past trading records, where you’ll find data on yearly and monthaly performance, as well as examples of how different risk profiles have affected results.